The Kobeissi Letter

We now have: 1. US President with a 100,000 price target on the Dow 2. New Fed Chair who is "required" to cut interest rates 3. $2,000 stimulus checks back in discussion 4. US government buying $200 billion in mortgage bonds 5. New $1.2 trillion funding bill signed into effect 6. Trump saying USD is "doing great" after -10% drop Own assets or be left behind. -

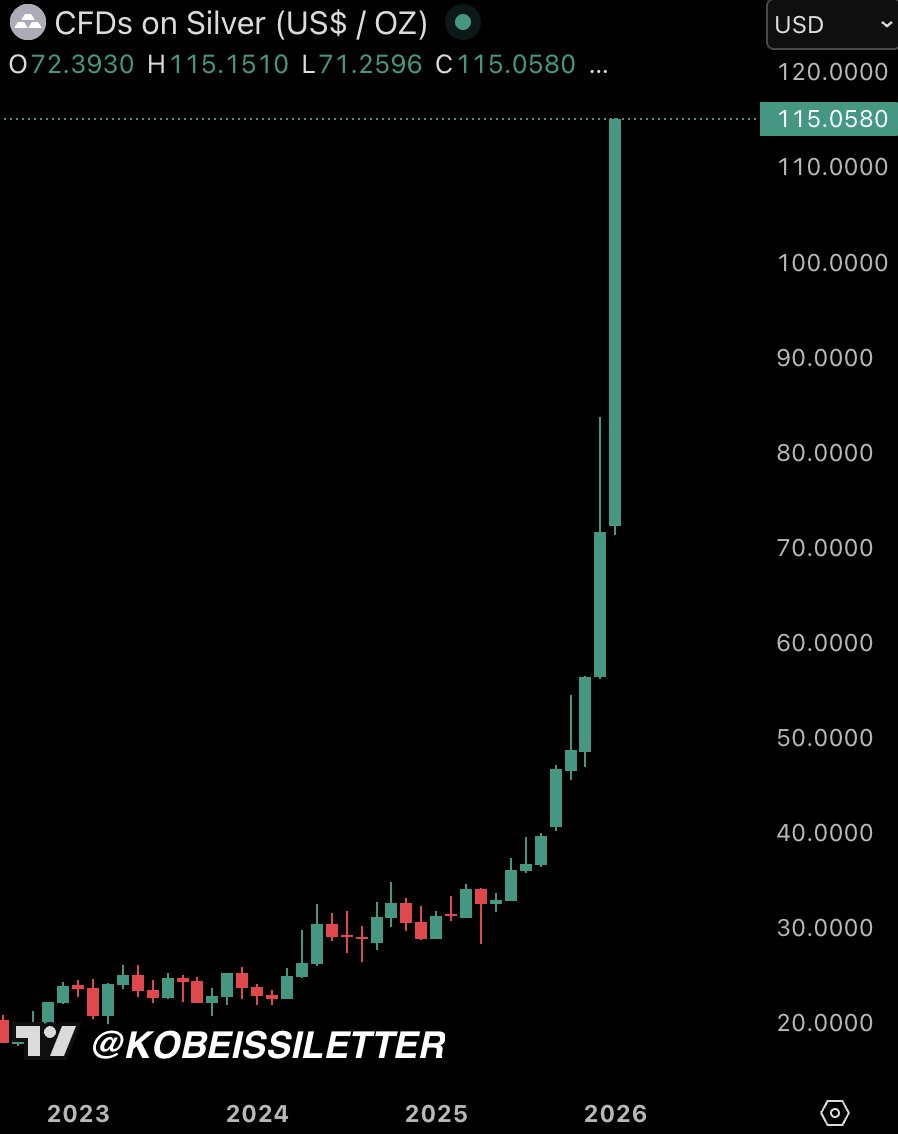

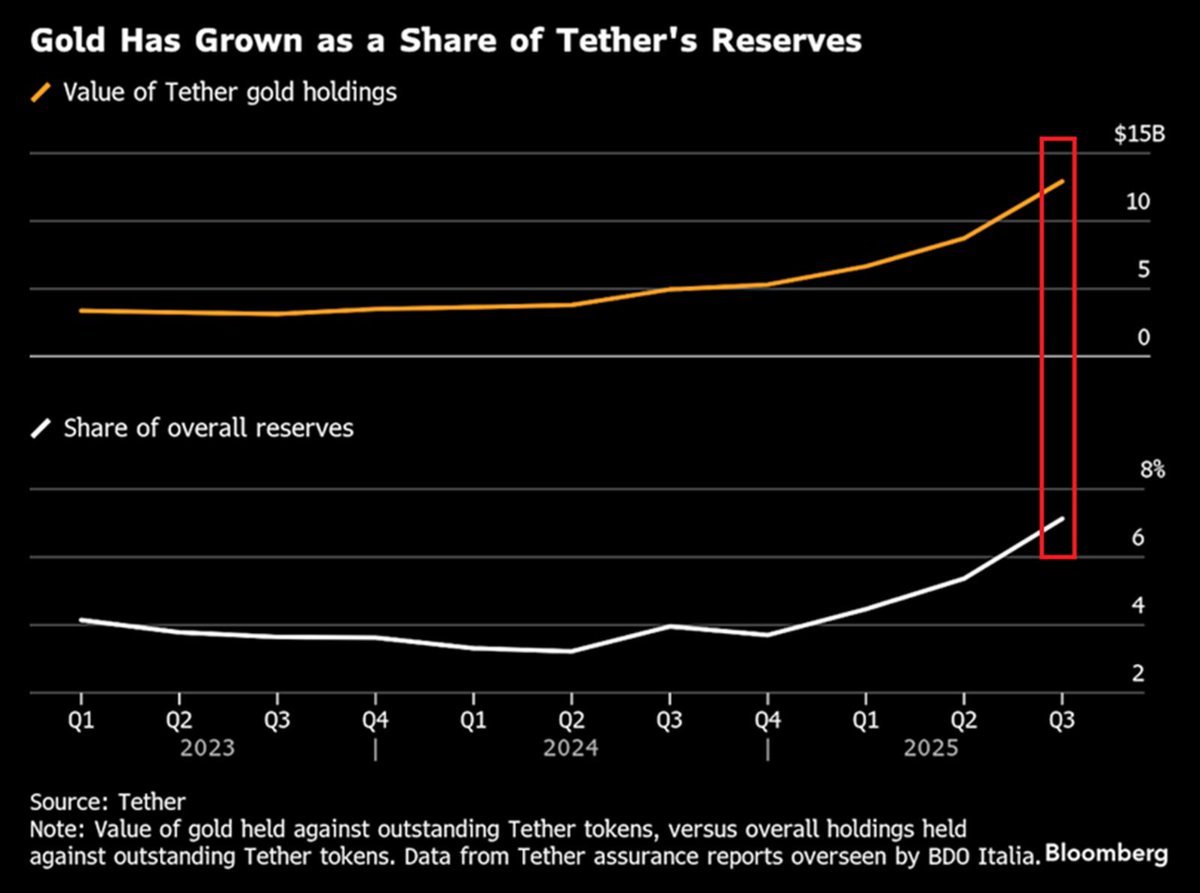

BREAKING: Tether now holds more gold than most central banks. Tether purchased +27 tonnes of gold in Q4 2025, bringing total holdings to a record 143 tonnes, now worth ~$24 billion. This follows +26 tonnes and +24 tonnes acquired in Q3 and Q2. By comparison, the Polish central bank, the most active buyer among reporting central banks, increased its total reserves by +35 tonnes last quarter to 550 tonnes. In 2025, Tether's gold buying also surpassed all but the 3 largest gold ETFs. Tether is disrupting the gold market. -

Most people don't realize what Trump just said: For 12+ months, the US Dollar has been in a sharp decline, falling -10% in 2025 in its worst year since 2017. Minutes ago, for the first time, President Trump commented on the decline in the USD: "The value of the Dollar is great," Trump said. This immediately sent the US Dollar another -1% lower, to its lowest level since February 2022. Why? It’s a clear signal that President Trump is willing to tolerate a weaker Dollar to push rates lower and boost US exports. Own assets or be left behind. -

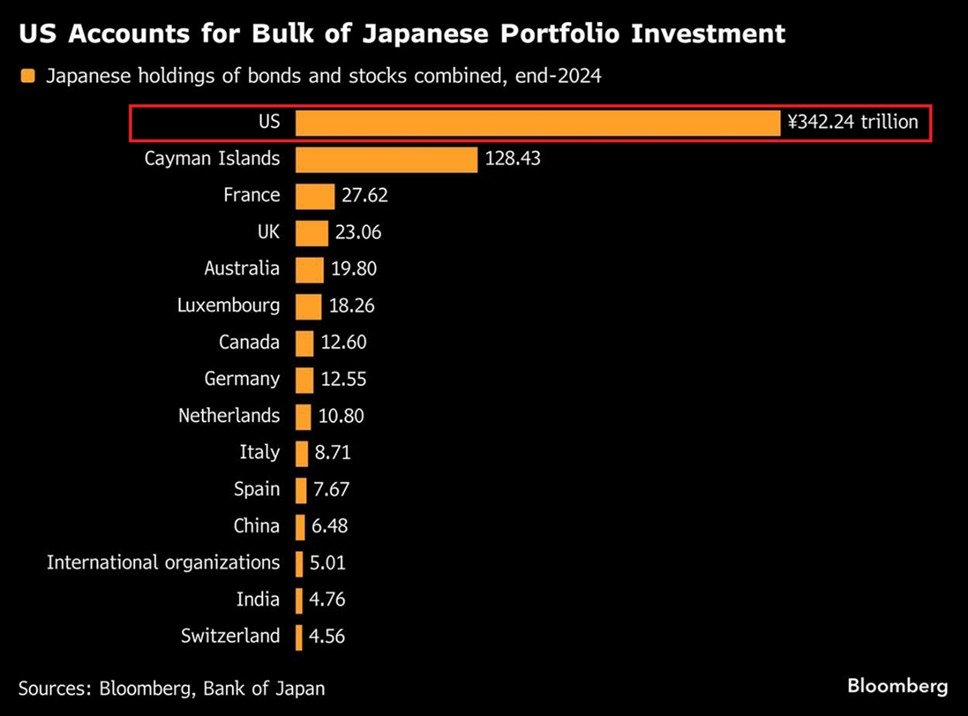

Japanese investors are a crucial part of US markets: Japanese holdings of US bonds and stocks totaled $2.22 trillion at the end of 2024, according to Bank of Japan data. This is followed by investments in the Cayman Islands, France, and the UK at $834 billion, $179 billion, and $150 billion, respectively. In other words, Japanese exposure to the US is TWICE as large as their combined positions in these 3 countries. Furthermore, total foreign assets owned by Japanese investors rose to $4.95 trillion in Q3 2025, near an all-time high. This comes as they held $2.54 trillion in equity and investment-fund shares and $2.41 trillion in debt. What happens if these investors start bringing money back home? -

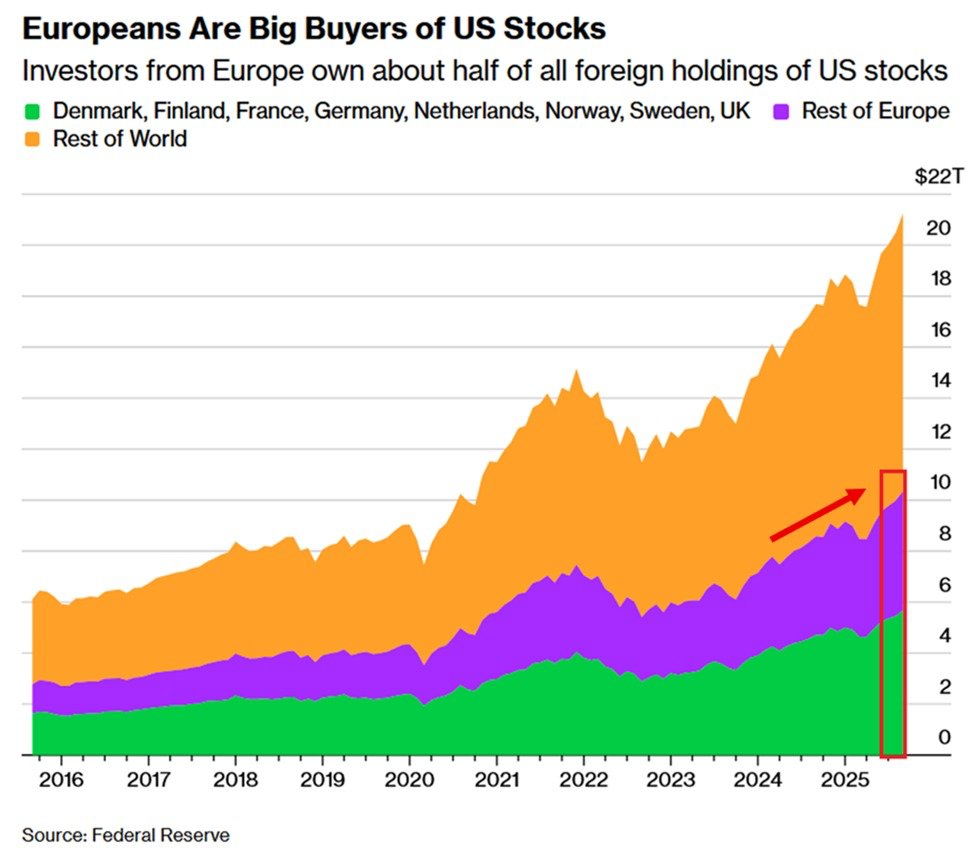

Europeans are piling into US stocks: European investors now own a record $10.4 trillion in US stocks. Ownership has surged +$4.9 trillion, or +91%, over the last 3 years. Denmark, Finland, France, Germany, the Netherlands, Norway, Sweden, the UK, now hold ~$5.7 trillion in US equities, or 55% of total European holdings. By comparison, the rest of the world holds $10.9 trillion. In other words, European investors now reflect ~49% of all foreign holdings of US equities. Europe’s exposure to US stocks is at unprecedented levels despite the trade war. -